Rather than a technical article about the aircraft industry this month I will focus on the psychological and the commercial.

I work with a lot of startup companies and like all startup companies, the companies that I work with are generally pre-revenue and they have to go out into the world and convince one or more investors to part with a lot of money. The risk is high but the rewards are great and there is a lot of competition.

Most of the projects I work with are started by engineers. Career engineers. Why is this significant? Well, it usually means that the projects are based, in reality, in terms of performance, certifiability and commercial aspects. People who have spent a good deal of time in the field of engineering understand the crippling limitations of physics, legislation and the market. Non ‘career engineers’ tend to shy away from tackling the critical minefield of reality

Communicating the reality of the ‘crippling limitations’ that you will be laboring under does not make a persuasive case for investment. But unless you are intimately familiar with them and your project tackles them head on with utter pragmatism there is a very good chance that you will fail. Investors don’t seem to care about how good you are at avoiding almost certain failure, but they should.

Crafting your communications with potential investors around unvarnished reality is not a winning approach, no matter how good you are at managing the risks and communicating those management skills, and this is a trap that many projects fall into.

Engineers fail to appreciate that no one else appreciates the things that they appreciate. Everyone else could be wrong, but that ‘everyone else’ class of the population includes all of the people who are likely to invest in your project.

So the messaging needs to bifurcate. Internal messaging in development is around identifying, documenting and resolving every problem, external communication is all about a vision of the future.

I am going to very badly paraphrase Maya Angelou: People do not remember what you said, or what you made them think. People remember how you made them feel.

A finely honed financial model with stunning market justification for your revenue stream where all risks are identified and mitigated may bring engineers (and all analytical modelers) out in a hot flush of excitement. But it does not have that effect on anyone else, including investors. Even though you would think that is exactly the kind of thing they should care about.

The truth is that human beings can review as many positive flow forecasts that you can throw at them. It does not make them feel anything.

My projects often express their frustration that apparently impossible and certainly impractical eVTOL programs can pull in hundreds of millions of dollars in investment and they can’t get a dime. Well – investors buy into dreams, they buy emotional validation and they invest in visions.

Investors (mostly middle aged men similar to myself) are as prone to emotional purchases as women buying makeup or clothes. Although men are far less likely to admit it.

These emotional animals are the people that you have to get investment from.

You can see exactly what they emotionally react to in a positive way as these are the projects that get invested. Joby, Vertical, Wisk, Archer, Volocopter. So what emotions are those projects selling? You can see that by looking at what they are buying.

An individual’s emotional makeup is both simple and complex. It is formed in childhood and modified throughout a lifetime.

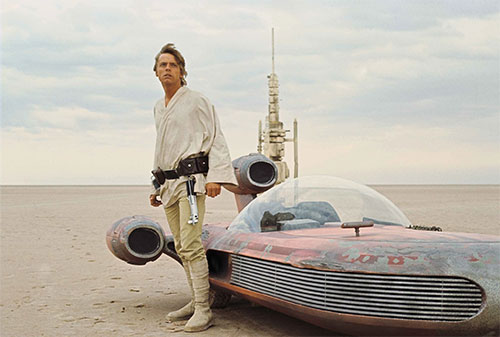

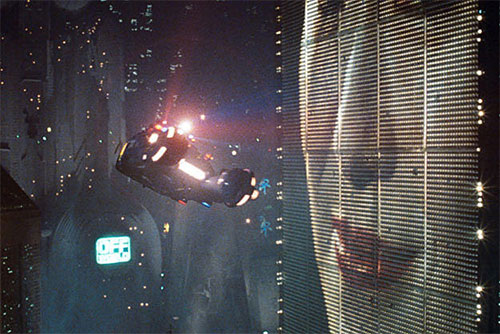

So what were all these investors exposed to growing up that would influence them all in one direction? They all grew up in an age where Star Wars, Star Trek and Blade Runner dominated the imagination of technical minded boys who looked to the future. They read Arthur C Clarke, Asimov and Heinlein, Frank Herbert and Harry Harrison. The same things I read and a lot of you probably read 30 years ago.

Deep in their mind they are still the 10 year old boy who watched as Luke Skywalker graduated from his old, rough landspeeder in the deserts of Tatooine to the X wing fighter. Or the pre teen who read Starship Troopers or Childhood’s End or the Foundation trilogy. That is what they are investing in: The imagined future of their childhood. They are trying to make it real.

They are no different from a woman investing in a pretty dress that they dreamed about as a little girl, or a lottery winner buying an E-Type or a Shelby Cobra. They are in part fulfilling a childhood dream. They are taking part in a shared fantasy that has the most flimsy fig leaf of a poorly conceived financial model to cover the secret that none of these programs are actually viable.

You can see symptoms of this. There is a great resistance to rational reassessment of the EVTOL field, this resistance is purely emotional – people will resist being woken up from a very pleasant dream. The petulant defense of the dream is almost childlike.

Reality does suck but in the end there is no escape from it.

You have to sell the dream and manage reality. The critical aspect is to sell a dream that, at least in part, is actually achievable.

Well written.