A version of this article first appeared in the August 2019 edition of our free newsletter, to subscribe click here

Over a year ago we published a white paper. This white paper was an attempt to codify a method for risk assessment method for aerial urban mobility development projects.

We made this assessment, and the accompanying spreadsheet tool, to try to make sense of the multiple configurations that are in play and make an honest attempt to determine which would have a chance of becoming an archetypal product: A product that would be a commercial success and define the market. The DGI Phantom of the manned urban mobility world..

One year on and the field of battle looks similar. Some projects have departed the field and some new contenders have entered the fray. Many are still diligently working away improving their concepts, looking for investment and building prototypes..

We have used our risk assessment spreadsheet tool to create a ranking chart for the projects currently in play.

These risk assessment scores are purely for civil certification and the manned civil marketplace. These designs may fare much better, or much worse as military or unmanned vehicles, these aspects have not been included in this assessment.

Also note that the assessment is based on two aspects only. Certification risk and market risk.

These two factors are judged to be the two most significant factors in the commercial success of an aircraft project – assuming technological feasibility.

The duration of the certification program is the greatest cost driver for the program. The more unique and complex the concept, the longer it will take to shephard through certification and the greater the overall development cost will be.

Market acceptance is the greatest driver for revenue (assuming you reach the market) and historically, the aircraft market has been famously conservative.

Program success and risk is entirely predicated on the potential of making a profit for the investors.

The more exotic the design the longer it will take to get through the certification process (e.g. AW609 tilt rotor) the greater the cost will be, and the greater market resistance when it finally gets there, no matter how great it looks (e.g. Piaggio Avanti).

High development costs and low sales – bad

Low development costs and high sales – good

That may come across as patronizing, but it is surprising how many projects lose sight of these fundamentals.

Any Innovation introduces these factors and risks. They have to be acknowledged, measured (if possible) and managed.

Some important notes:

- If you are connected to a project in the chart and you disagree with the ranking you have received, please download and read the white paper that defines the methodology, if you want to know how I have applied the scoring system feel free to contact me. I will not change the rankings but I will explain the outcome to you.

- Just because something is possible to make and fly it does not mean that it is affordable to get it through the certification process or that anyone will buy it.

- Just because a project has 10,000 advance orders it does not mean it will make it through certification and reach the market.

- And just because a project achieves type certification and has 10,000 orders it does not mean that they will sell at a high enough margin to make a profit.

- The ranking given in this study may have some correlation to projects that succeed. However, the devil lives in the details and the execution of a project is critical, therefore the results of this study are idealized and simplistic

- We applaud anyone who has the initiative to design, make and fly a unique air vehicle and go through the hard work of chasing investment. It is a difficult, risky, all consuming pursuit and all of you are doing your best to advance the industry and improve lives. We wish all of you success. The rankings are a measure of relative potential success. This is not an absolute measure – all may fail or all may succeed…..and of course we could be completely wrong.

- I have had informal communication and commercial relationships with many of the projects or people involved in these projects. I have tried my best to remove my personal bias or hopes from the assessments made to create the rankings. Where I have had an advisory or technical relationship with any particular project I will highlight it where relevant

Data

The projects and some of the data has been taken from the excellent http://evtol.news website. It must be made clear that evtol.news have no part in generating these rankings and I have only used them as a very useful resource.

As per the http://evtol.news website I have broken down the projects into the following categories:

Vectored Thrust

An eVTOL aircraft that uses any of its thrusters for lift and cruise.

Lift + Cruise

Completely independent thrusters used for cruise vs. for lift without any thrust vectoring.

Wingless MultiCopter

No thruster for cruise – only for lift

Hoverbikes

The general class of hover bikes or personal flying devices with the primary differentiation being that the pilot sits on a saddle or is standing, or something similar. All are multicopter-type wingless configurations

Electric Rotorcraft

An eVTOL aircraft that utilizes a helicopter frame

Each of the above categories are plotted relative to each other and the data of the individual category graphs are shown relative to the field of the overall data.

I have not listed all of the projects referenced from the http://evtol.news website. Where the project was listed as defunct, was clearly an amatuer student project, was clearly very preliminary or had few useful details the project was omitted.

Our intent is to update the rankings on a semi-regular basis and projects come and go and projects refine their designs.

Results

For each category of UAV we have created a graph. This graph represents the certification and market risk. The further the trace is to the upper right hand corner the better the overall score, the closer to the bottom left hand corner the lower the overall score.

For each category we have listed the top 50% of the projects highest score first.

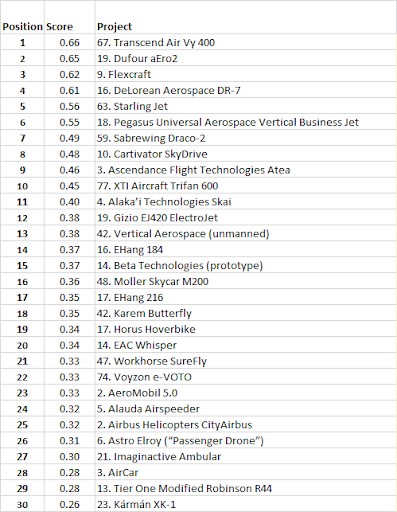

For the overall list of projects we have listed the top 30 and feature the top 5 in a little more detail.

The full spreadsheet of all the results is available on request.

The spread of scores for the 130 projects used for this study is as follows:

This spread of results shows a normal type distribution (bell curve), the mean score is 0.05 and the standard deviation is 0.26.

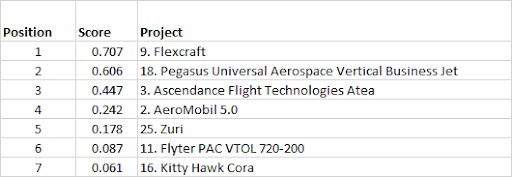

Vectored Thrust

Comment:

The vectored thrust projects occupy the range from the very low scoring to the very high scoring. This is due to the range of concepts on offer.

The better scoring concepts have limited mechanical complexity.

Simplicity is good for certification and the market. Complexity is poor for certification and the market.

Top 50% Vectored Thrust Projects

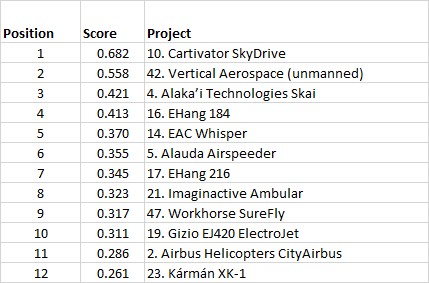

Lift + Cruise

Comment

The lift and cruise category tend to moderate the range of design concepts on offer to ones that appear more conventional and this results in an overall better market score.

However the range of complexity on offer creates a wide spread of certification scores.

Top 50% Lift + Cruise Projects

Wingless MultiCopter

Comment

Wingless multicopters tend to have low mechanical complexity and this results in generally high certification scores.

However, the non conventional multirotor configuration makes these aircraft a difficult sell in a conservative marketplace

Top 50% Wingless Multicopter Projects

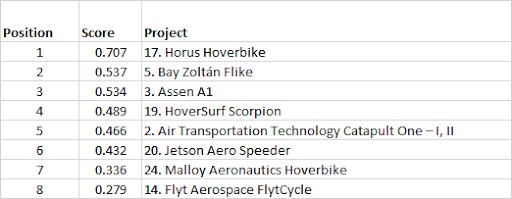

Hoverbikes

Comment

Hoverbikes are generally simple, and carrying only one person and having a lower gross weight makes them more suited to the certification process.

The low carrying capacity reduces the size of the market and the potential for making a profit on these projects is limited.

Top 50% Hoverbike Projects

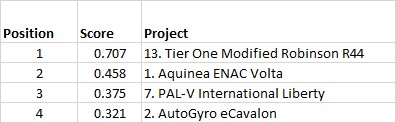

Electric Rotorcraft

Comment

Some Electric rotorcraft have high market acceptability as they resemble traditional helicopters, the more exotic concepts

Top 50% Electric Rotorcraft Projects

Results Summary

Top 30 Overall Projects

Conclusion and Round-up

The top rated projects are as follows

- TranscendAir

This placing of this project came as a surprise to me – but it is clear why they have placed at number one in the list. The aircraft has only two lift rotors and is largely similar to the V-22 configuration.

Certification abhors innovation and the familiarity of this design concept will serve it well with certification and the market.

2. Dufour aEro 2

Dufour is another twin lift propeller, tilt wing. It looks conventional but has VTOL capability. The tail mounted propeller gives additional motive power for horizontal flight.

Simple, almost conventional. Low risk

3. Flexcraft

Fixed wing with embedded lift fans and pusher propeller for level flight. This is a simple approach and looks conventional. Similar to the Ryan Vertifan this concept is relatively low risk and benefits in both the certification and market metrics.

4. DeLorean Aerospace

DeLorean combine a relatively conventional configuration (tailless canard) with great looks thanks to project lead Paul DeLorean. Two lift fans that also serve for level flight.

In the interest of full disclosure, I am an advisor to the DeLorean project. They have been quiet recently but I expect we will hear about some progress in the near future.

5. Samad Aerospace Starling Jet

Samad Aerospace Starling Jet is a personal favorite of mine. I was privileged to be their acting CTO from 2018-2019.

An attractive classical design (reminiscent of the old Handley Page Victor – thanks to the multi-talented Norman Wijker) paired with relative simplicity makes this a high scoring configuration.

Conclusion

My experience, and the historical record, shows that simplicity and convention do well in the certification process and the market.

If we are about to see a paradigm shift the future could look quite different. Has the psychology of the regulator and the market shifted to the degree where success of these new types of aircraft is now possible? Or are we limited to moving forward in small, low risk increments?

Will the world’s emerging economies and societies with their ability to embrace change, be the environment where these certification and market innovations are possible?

Or will the FAA and EASA lead the way?

Hello.

First of all thanks for this high quality analysis. As usual your analysis are relevant.

I’m suprised to not see Lilium in the top ranking. Do you confirm ?

Also would it be possible to get your spreadsheet ?

Thanks for your site and your approcah !

Steve,

Lilium is a nice project but the technological and certification risks are high. Certification abhors innovation……

I have some connection to the project and I like it, but certification will not care how much I like it!